Vic Womersley - 10 min read

Hassan Thwaini - 8 min read

Editor's Pick

Foods to Avoid

Are there any foods to avoid while taking mirtazapine?

Hassan Thwaini

Diet Guides

What is the liver reduction diet?

Health Times Editors

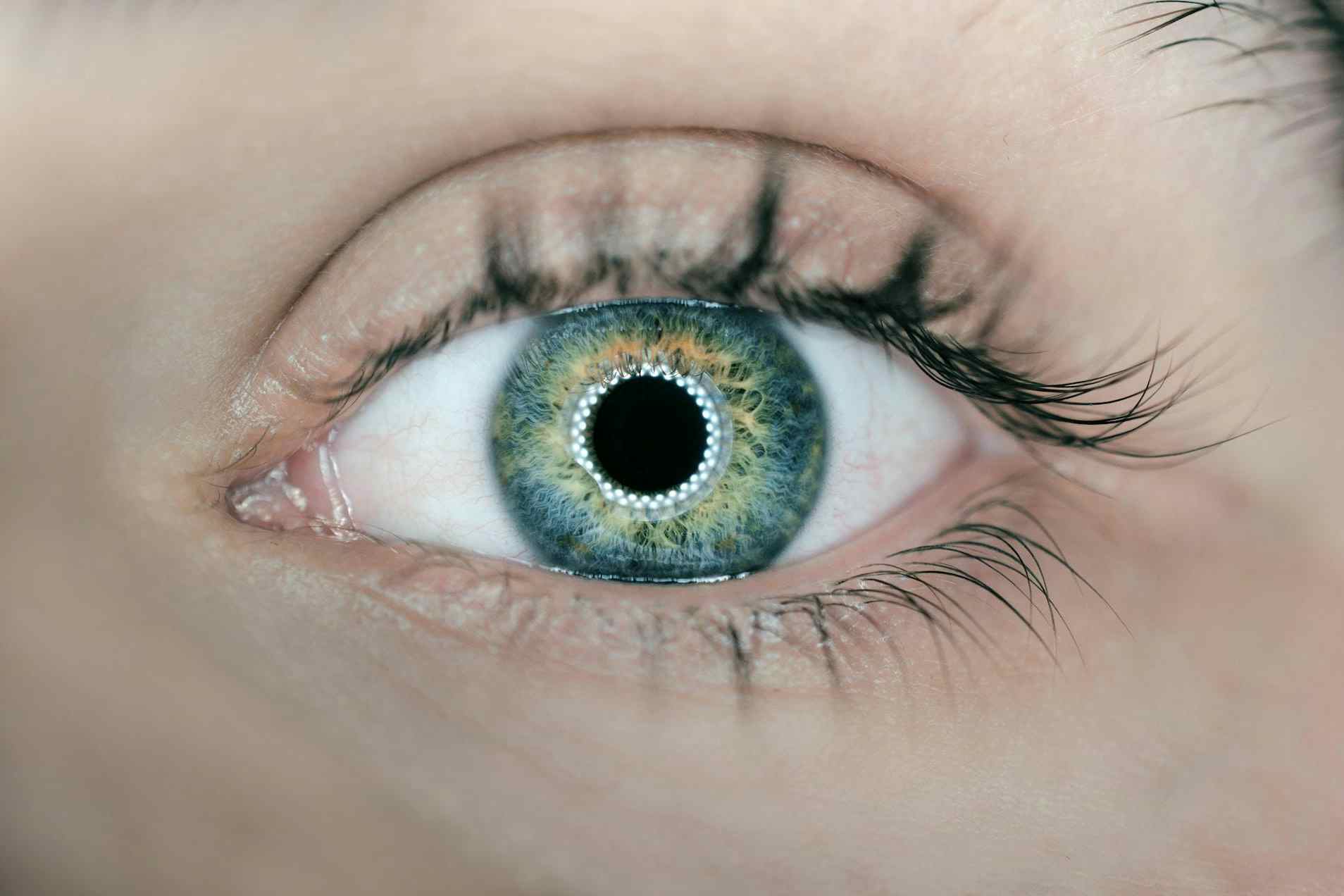

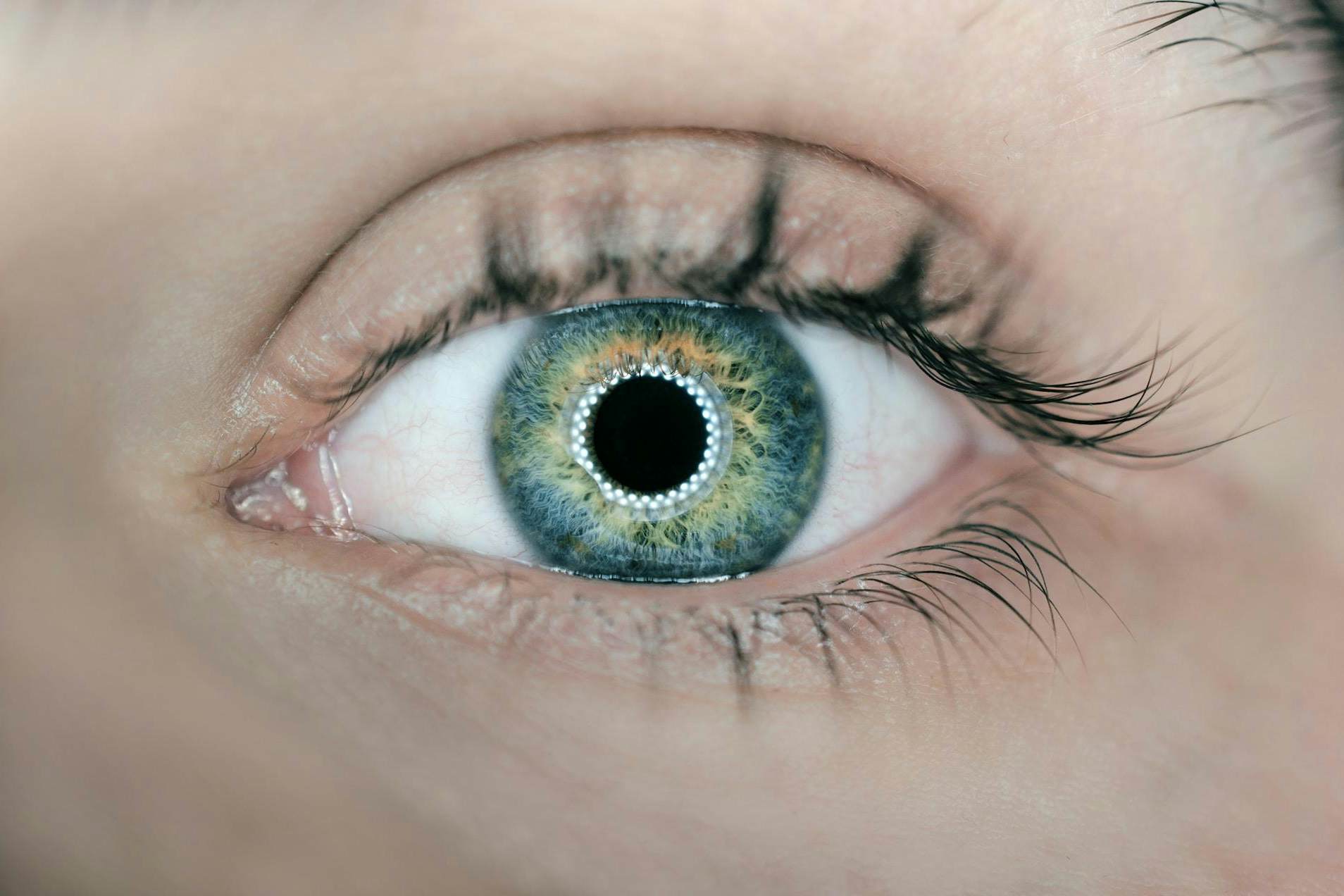

Eyesight

What is commonly misdiagnosed as pink eye?

Hassan Thwaini

Caring for Loved Ones

What is the HCPC and what does it do?

Katie Howe

General Health

What could your chesty cough indicate?

Emily Fay

You Should Know

Recommended Reading

Advertisement

Health Conditions

Emily Fay - 5 min read

Vic Womersley - 7 min read

See More from Health Conditions

1

Hassan Thwaini - 6 min read

2

Hana Ames - 4 min read

3

Hana Ames - 8 min read

Alternative Therapies

Vic Womersley - 10 min read

Vic Womersley - 10 min read

Food & Nutrition

Hassan Thwaini - 10 min read

Hassan Thwaini - 7 min read

Healthcare

Ageing

Savana Khallouf - 5 min read

See More from Ageing

Mental Health & Wellbeing

Hassan Thwaini - 9 min read

Hassan Thwaini - 5 min read

Fitness & Exercise

Matt Smith - 8 min read

Advertisement